Do California income tax laws really hamper the Dodgers efforts to sign top name players?

It probably did with Carlos Lee. But what many people aren’t aware of is that there are players that are steered away from the Dodgers and towards such destinations as Texas, Florida or Washington because there is no state income tax there.

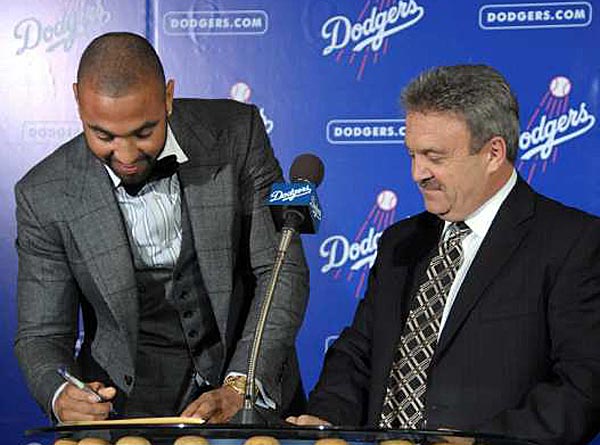

Fortunately, California’s high income taxes didn’t prevent Matt Kemp from signing his 8-year/$160 million contract extension with the Dodgers. (Photo credit – Kirby Lee/US PRESSWIRE)

California, with its high income tax rate, is known as one of the most aggressive states in seeking out and taxing visiting athletes when they play here. If a player signs with the Dodgers, for example, his taxable income is divided up in prorated fashion based on where he has played. Major League ballplayers collect a state issued W-2 from every state in which they play their games. A Dodger player will realistically have a higher income tax bill than a player from the Rangers, Astros, Mariners, Marlins or Rays, because they’ll compete in more games in taxable states. For example, with 162 games divided up by 81 home games, a Dodger player will add 9 in San Francisco, 9 in San Diego, another 3 in Anaheim. That alone gives him 103 taxable games at the highest rate in the nation. A Marlin will end up with less than 50% of the games he played in being calculated for taxable income.

I understand that most players are millionaires, but these tax fees add up. A player from Texas making $5 million per year is probably looking at a cumulative state income tax bill in the neighborhood of $90,000 (based on a 4.5% rate over 73 games played in taxable states). A Dodger player making that same salary will pay approximately $342,500 in cumulative state taxes. He pays more because the high tax rate for California is near 10% and then you add in all the other taxable states he will play in. At the end of the season, a Dodger will only play in about 6 non taxable games in Florida and Texas, (this year they got an additional three in Washington).

Those numbers are significant and make an impact when players move from team to team. Do you think Carlos Lee thought about it when he was contemplating accepting a move to the Dodgers? You bet he did, and his agent Scott Boras most certainly told him of the financial implications. Lee wasn’t worried about the cattle at his ranch when the Marlins trade proposal came his way, he was gone lickety-split.

Was it really a cattle ranch that prevented Carlos Lee from signing with the Dodgers or was it California’s high income taxes? (Photo credit Mike McGinnis)

When the Dodgers negotiated with Kevin Brown about 13-14 years ago, they had to sweeten the deal to make up for the extra income tax he would be playing based on the number of California games he would be playing. The same happened with Gary Sheffield when the Mike Piazza deal was made in 1998. You might remember that the Sheffield contract had to be renegotiated to finalize that deal because he was going to lose several hundred thousand dollars by paying more in state income taxes.

Former Dodger slugger Gary Sheffield renegotiated his contract to adjust for California’s higher income taxes. (Photo credit Brian Bahr / ALLSPORT)

Now we have already seen this impact them in trading for a 5-5 player before the trade deadline. As the Dodgers become major players in player acquisitions and more-so this off-season, they will have to factor this disadvantage they have as a California team in their negotiations with free agents. They aren’t alone with this problem, and large market teams have overcome this, (i.e. Yankees and Mets-New York state income tax rate is over 9%). But I can’t help but see other teams having a distinct advantage in this infrequently noticed area. Aside from Texas and Florida having zero state income tax, Pennsylvania’s state income tax rate in the highest bracket is 3% and Massachusetts is at 5%.

Will California’s higher income taxes prevent the Dodgers from acquiring soon-to-be free agent Josh Hamilton? (Photo credit – FranklinBaseball.com)

A player like Josh Hamilton in Texas will be well sought after this coming off season and the Dodgers are thought to possibly be in the mix, but they’ll need to sweeten their offer to him due to the tax implications that being a California team brings them. If there is a bright side to this situation though, the Giants are in the same boat… and they don’t have as much money as the Guggenheim group to spend away in the free agent market.

July 6th, 2012 at 5:33 am

July 6th, 2012 at 5:33 am  by Evan Bladh

by Evan Bladh  Posted in

Posted in

What an interesting article – I never heard of or thought of the tax implications. Somehow when you are making a “zillon” dollars it would hardly seem to matter but I can see this on the thought process of those “only” make $1-3 mil.

A very interesting and thought-provoking post, Evan.

California is definitely screwed up and every year my taxes go up, but it is pretty tough for me to feel sorry for guys making multi-millions of dollars to play what my good friend Gary Smith calls “a kids game.”

Those on the liberal side of the aisle are constantly voting in new tax increases on the extremely wealthy which, of course, always land in the laps of the working middle class, so if the Dodgers are unable to sign big name players due to high state taxes in California, perhaps it is our state legislators who should share some of the blame – but they won’t because they simply don’t give a damn.

Thanks for the comments Linda and Ron. I really didn’t intend for this post to go political. I got to thinking about the topic when Carlos Lee waivered for so long in making his decision and then immediately high tailed it for Florida as soon as they announced that deal. I always knew that players coming to California had structured deals that were a bit higher due to tax implications, but after doing the calculations, Dodger, Giant, Angel and Padre players pay a lot more in state income taxes than most players in the league. I think a lot of them come to California in an effort to play near their native homes. If it wasn’t for that and the amazing weather we have, I’d think that hardly anyone would come play out here.

It is impossible to avoid politics whenever tax is involved. You ever wonder why tax and ax sound so similar? It’s because they both cause permanent separation.

The teams in states that tax income have to pay higher salaries to compete with teams in tax-free states. This has been the case for years and salaries reflect it.